Everything a pro needs, all in one suite — that’s Microsoft Office 2021 Professional.

Microsoft Office 2021 Professional is the perfect choice for any professional who needs to handle data and documents. It comes with many new features that help boost productivity in every stage of development, whether it’s processing paperwork or creating presentations from scratch – whatever your needs are!

The tools within this suite have been redesigned so they can be used equally by designers looking for inspiration on how best to present their work, as well as data analysts working with large sets of data for their company, and reports; there really isn’t anything left out when using these applications.

The ribbon-based user interface provides quick access to all its available features, tools, and customizations. Users can easily customize font, layout, indentation size of type in documents as well as many other details. Make more aesthetically pleasing documents without sacrificing functionality for work-related needs like formatting emails or creating presentations.

- Lifetime license for MS Word, Excel, PowerPoint, Outlook, Teams, OneNote, Publisher, & Access

-

One-time purchase installed on 1 Windows PC for use at home or work

- Instant Delivery & Download – access your software license keys and download links instantly

- Free customer service – only the best support!

Office Professional 2021 includes:

Office Professional 2021 includes:

- Microsoft Office Word

- Microsoft Office Excel

- Microsoft Office PowerPoint

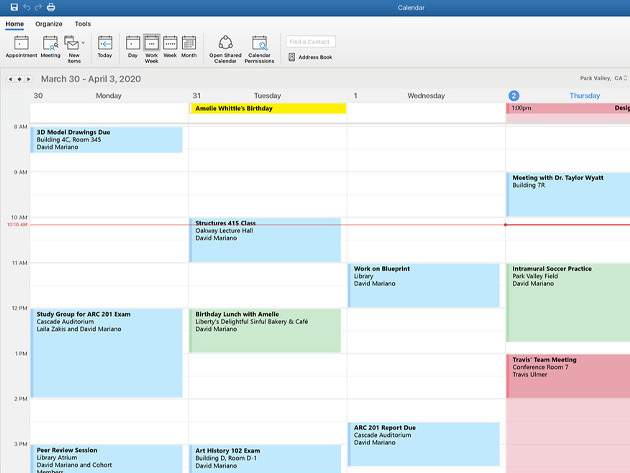

- Microsoft Office Outlook

- Microsoft Office Teams (Free version only)

- Microsoft Office OneNote

- Microsoft Office Publisher

- Microsoft Office Access

- Skype for Business

The product you are purchasing is NOT MICROSOFT 365. Please read the product details.